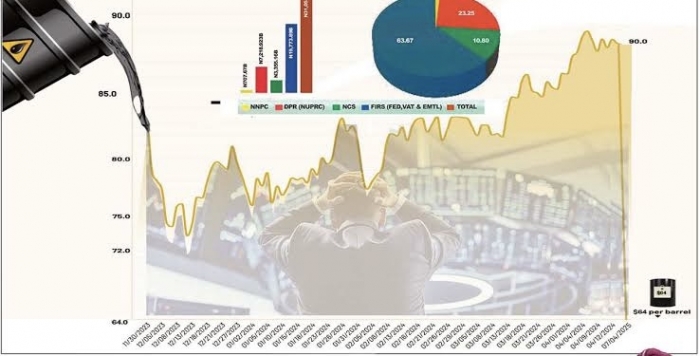

Global oil prices plummeted to four-year lows Wednesday, with Brent crude crashing 3.4% to $60.69/barrel and WTI falling 4% to $57.22, as the U.S. imposed 104% tariffs on Chinese imports - a move that could cripple Nigeria's oil-dependent economy already reeling from production shortfalls and stalled reforms.

Trade War Triggers Market Collapse

The tariff escalation between the world's top two economies has sparked fears of a global recession, with Rystad Energy warning China's oil demand growth could drop by 100,000 barrels daily. The crisis compounds existing market pressures after OPEC+'s decision to increase output by 411,000 bpd in May.

Goldman Sachs now forecasts Brent could fall to $55 by 2026 - $20 below Nigeria's 2025 budget benchmark of $75/barrel. With current prices at $60, Africa's largest oil producer faces a catastrophic revenue shortfall.

Nigeria's Perfect Storm

The petroleum sector's collapse threatens to:

1. Derail the N55 trillion budget

- Already, Q1 2025 saw N5.4 trillion in unrealized oil revenue due to production deficits

2. Trigger massive borrowing

- The fiscal deficit could surpass N13 trillion as net oil revenues dwindle to $25/barrel after $40 production costs

3. Paralyze refineries

- Dangote Refinery may abandon U.S. crude imports due to tariffs, while domestic supply constraints worsen

4. Worsen debt crisis

- Crude-backed loan repayments face default risks with dwindling output

"At below $70 oil, we're in crisis territory," warned NES President Adeola Adenikinju. "The budget framework is becoming impractical."

Production Woes Compound Crisis

Despite briefly hitting 1.54 mbpd in January, Nigeria's output remains 25% below its 2.06 mbpd target. February saw production crash to 1.46 mbpd, resulting in:

- 15.5 million barrels lost in January ($1.13 billion revenue shortfall)

- 16.8 million barrels lost in February ($1.26 billion deficit)

- 15.5 million barrels lost in March ($1.03 billion gap)

Energy lawyer Ameh Madaki blasted Nigeria's "fraudulent budgeting process," noting: "We're borrowing to fund fiscal recklessness while citizens suffer."

No Easy Solutions**

With tax reforms stalled in the National Assembly and NNPC's new leadership needing months to address oil theft and production challenges, economists urge emergency measures:

- Immediate budget revisions to reflect $60-$65 oil reality

- Drastic cuts to wasteful expenditures

- Accelerated economic diversification

As Wood Mackenzie warns of prolonged $73 oil averages, Nigeria faces its worst fiscal crisis in a decade - caught between global trade wars and domestic production failures that could collapse its 2025 economic plans.